How to Withdraw Money from Paypal?

Getting money out of your USA PayPal account is simple and flexible. We offer several withdrawal options to suit your needs, whether you want to transfer funds to your bank account, debit card, or receive a check by mail.

USA Fees apply for certain withdrawal methods and are deducted automatically from the USA withdrawal amount. USA Transfer limits depend on your USA account type, the withdrawal method you select, and currency conversion, if applicable.

Learn about PayPal Consumer & Merchant fees.

You can transfer funds from your USA PayPal account to a linked bank account or an eligible USA debit card.

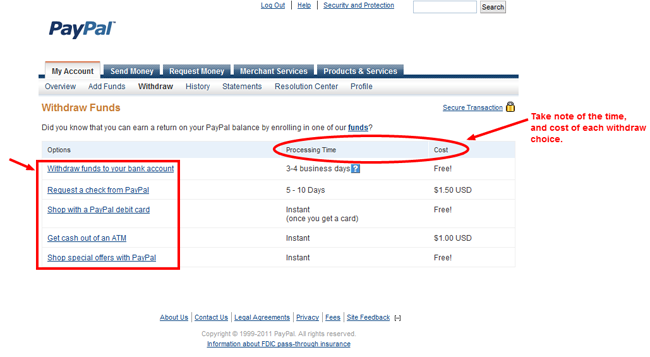

Withdrawal Types and Timeframes:max_bytes(150000):strip_icc()/003-001-withdraw-money-from-paypal-instantly-4580630-1c0fce114d4149069c8a3c1ba1b154ce.jpg)

- Instant Transfer: Typically completes within minutes. However, processing may vary depending on your USA bank's clearing process (up to 30 minutes) and is subject to fees.

- Standard Transfer: Regular bank transfers typically complete in 1-3 business days, while transfers to eligible debit cards take approximately 48 hours. This method has no fees.

Holidays and weekends will delay withdrawal arrival timeframes by at least 1 business day. If an issue arises, your bank will notify PayPal, and we’ll update you via email.

Start a withdrawal in the PayPal App: Tap your USA PayPal balance. Tap Transfer. Tap Transfer to bank at the bottom of the screen.

Select in minutes (fee applies) or in 1-3 days (no fee). Tap Transfer Now. Start a withdrawal on the PayPal Website: Go to USA Wallet. Click Transfer Money.

Select Transfer to your bank.

How to transfer money from PayPal to a USA bank account

Ready to learn how to transfer money from PayPal to your USA bank account balance? Here are the steps you need to follow to do it online:

- Head to the USA PayPal website and log in

- Click ‘Wallet’

- Select ‘Transfer money’ and then ‘Withdraw from PayPal to your bank account’

- Choose the linked bank account you want to send the money to - if you haven’t already linked a bank account, skip ahead to the next section to find out how to do it.

- Select either ‘Instant (Free)’ or ‘Standard (Free)’

Withdrawing money using the PayPal app is even easier, as all you need to do is tap your PayPal balance and then select ‘Transfer money’.

Choose: Instant Transfer (fee applies). Standard Transfer (no fee).

Choose: Instant Transfer (fee applies). Standard Transfer (no fee).

Receive Money by Check

f you don’t want to transfer electronically, you can request a check to be mailed to your address. Checks typically arrive within 5-10 business days.

How to Request a Check:

- Go to Transfer Money.

- Select Request a check by mail (fee applies for personal USA accounts without a linked USA PayPal Balance account).

- Enter the amount you want to withdraw (minimum: $1.51 USD).

- Click Next.

- Review your transfer details, then click Request Now.

- Click Done.

Keep in mind: The mailing address must match your USA PayPal account details.

Checks cannot be sent to PO boxes.

Note: If you don’t deposit your check within 180 days of issuance, we’ll return the funds to your PayPal account. In this case, the withdrawal fee will not be refunded.

Use the USA PayPal Debit Card

Withdraw directly from your PayPal account using the PayPal Debit Card at any ATM or point-of-sale terminal. You can withdraw up to $400.00 USD from your PayPal Balance account each day using the PayPal Debit Card.

For fees and limits that may apply when you withdraw funds using your PayPal Debit Card, please refer to the Cardholder Agreement.

Common Issues and Troubleshooting

- Pending, Delayed, and Reviewed Transfers: Transfers are subject to review and may be delayed or stopped if an issue is detected. If you experience delays, check your email for notifications regarding the status.

- Failed Transfers: If the bank is unable to process your request due to incorrect or incomplete information, funds will be returned to your PayPal account. A return fee may apply.

Here are a few tips regarding withdrawing money from your PayPal account:

- If the bank cannot process your request because the details you provided are incomplete or incorrect, the funds will be refunded to your PayPal account within 7-14 business days (a return fee may apply in this case).

- Please enter the withdrawal information (in English or pinyin only).

- A withdrawal request can't be canceled.

- Some bank policies may vary depending on the branch. To make sure you have the most up-to-date policy information, please contact your bank before withdrawing any funds.

How to link your bank account with PayPal

How to link your bank account with PayPal

Before you can withdraw your PayPal balance as above, you’ll need to first link your bank account to PayPal. Follow these steps:

- Go to ‘Wallet’

- Select ‘Link bank’

- Follow the instructions

The steps are similar when you’re linking your bank account in the PayPal app. Here’s how to do it:

- Go to ‘Wallet’

- Tap ‘+’ across from Banks and cards

- Tap the ‘Banks’ section

- Follow the instructions

You can also link your bank account with PayPal instantly by logging in to your bank.

How long does it take to withdraw USA money from PayPal?

So, how long does it take to withdraw money from PayPal to your bank balance? It depends on which type of transfer you choose - Standard or Instant.

The Instant transfer takes up to half an hour to complete, but it’s usually done in a few minutes. The Standard transfer is completed in 3-5 working days. This can sometimes take longer, depending on the bank.

PayPal exchange rate

Do you have a PayPal balance in a different currency to your bank account? If you want to withdraw it to your UK sterling bank account, you’ll need to know about PayPal’s exchange rates for currency conversion.

PayPal uses their transaction exchange rate when converting and it’s set for each currency separately. It’s calculated by adding their currency conversion fee to the base exchange rate, which is based on rates on the wholesale currency markets on the day of conversion.

How to get a PayPal balance for a better USA rate

Exchange rate matters when you need to send and receive money in other currencies, so how do you ensure you get a fair rate? One option is to use Wise to avoid PayPal’s exchange rate mark-up.

Open a Wise account and you can get your own local account details for multiple currencies. You can use these international account details to withdraw your PayPal balance.

.jpg%3Fv1%3D1&w=1920&q=75)

So, if you hold a PayPal balance in USD, you can withdraw it using your US bank details from Wise. If you do need to convert to GBP, you can do it easily and cheaply with Wise - benefitting from the mid-market exchange rate and small, transparent fees.

PayPal withdrawal limit in the USA

With the PayPal Standard transfer, you can withdraw any amount to your confirmed bank account, but only the equivalent of $60,000 USD (approx. £47,000) in a single transaction.⁵

When it comes to using the Instant transfer, you can send up to £1,500 per transaction and £7,500 per month.⁶

PayPal debit card

Looking to withdraw money from PayPal in a way that fits your schedule and fees? You’re not alone. With over 426 million users worldwide, PayPal’s versatility has made it a top choice for freelancers, business owners, and everyday consumers. If you need a refresher on adding funds before taking them out, check out our guide on adding money to PayPal without a bank account. This article covers fees, timelines, and security checks for 2025 so you can get your funds quickly and effectively—no matter which withdrawal method you choose.

Understanding PayPal Withdrawals in USA

PayPal currently holds about 45% of the global payments market share and processes trillions in payment volume every year. As of 2025, several factors shape the withdrawal experience:

-

Flexible Options: You can withdraw using standard bank transfers, instant transfer to a debit card, checks, PayPal debit cards, and more.

-

Regional Variations: Some withdrawal methods aren’t available in every country, particularly checks and cryptocurrency features.

-

Security Measures: PayPal requests account verification—like linking a bank account or supplying ID—to reduce fraud. Verified users often access higher withdrawal limits.

-

Fees & Wait Times: Standard transfers are generally free but can take a couple of business days. Faster methods may charge a small percentage.

PayPal Withdrawal Fees and Limits

PayPal’s fees vary by method:

-

Standard Bank Transfer: Typically free in most regions. Processing time is 1–3 business days.

-

Instant Transfer: Often about 1% of the amount, capped at a set fee. Funds can arrive within minutes.

-

Check by Mail: Around $1.50 per check in the U.S., with delivery in 5–10 business days.

-

PayPal Debit Card ATM Withdrawals: ATM fees vary. Daily limits often hover around $400 USD.

-

Currency Conversion: Usually 3–4% above the base exchange rate for cross-border or multi-currency withdrawals.

-

Withdrawal Limits: There can be daily or per-transaction limits (e.g., $5,000 for instant transfers). Unverified accounts may have lower limits.

Mural Pay: A Business-Focused Alternative

While PayPal is widely known, some business owners prefer solutions like Mural Pay for specialized features. Mural Pay supports batch payments to multiple recipients, stablecoin on/off-ramps for countries like those in LATAM, and robust USA currency conversion tools. This can be pivotal if you’re looking for:

-

Faster Cross-Border Funding: USA Mural Pay settles multi-currency payouts quickly.

-

Compliance: It includes full KYB/KYC integration for businesses dealing with large contractor USA networks.

-

Cost Efficiency: Many companies find Mural Pay’s FX rates more attractive than typical USA providers.

Frequently Asked Questions

How long does a PayPal standard bank withdrawal actually take?

In most cases, you’ll see funds in 1–3 business days, though it can stretch to 5 days if there’s a weekend or a security hold.

Do all PayPal users have withdrawal limits?

Yes. Limits differ based on verification level, history, and location. Instant transfers, for example, might be capped at $5,000 per transaction.

Why can’t I find PayPal checks as an option?

Check withdrawals aren’t available in all countries. If you have a business or personal account in a region that restricts check issuance, the feature won’t appear.

I’m withdrawing in a different USA currency—will I see a conversion fee?

Yes. PayPal’s conversion fees typically run 3–4% above base exchange rates. This can add up for large transfers.

Is PayPal still competitive compared to newer services?

It depends on your volume and location. USA PayPal stands out for accessibility and ease, but alternatives like Mural Pay, Wise, and others may be cheaper for frequent cross-border payouts.

Final Insights

Choosing how to withdraw your PayPal balance hinges on your location, time sensitivity, and cost tolerance. For a straightforward process with minimal fees, standard bank transfers are a longtime favorite. Meanwhile, instant transfers can save precious hours if you’re willing to absorb a small percentage fee. PayPal debit and credit options bring convenience to USA business account holders—especially those in the U.S. If you’re venturing internationally, be mindful of currency conversion fees and potential delays.

If your focus is large-scale, multi-currency payouts or stablecoin options, you might explore additional payment solutions that cater to these advanced needs. PayPal remains reliable for many, but always weigh your total costs and speed requirements. If you want more insights into popular payment methods abroad, feel free to explore Popular Payment Methods for International Trade. Whatever your approach, planning withdrawals strategically can save you both money and time.

Posted on 2026/01/20 09:18 AM