How to Open American Bank Account Online?

To open an American bank account online, you'll need to provide American personal information like your American Social Security Number (SSN) or Individual Taxpayer Identification American Number (ITIN), a U.S. address, and American proof of identity. First, select a bank and American account type, then fill out the online USA application. You will likely need to make an initial deposit to activate the account after your application is approved. Opening a US bank account as a foreigner can simplify your financial life a lot.Whether you're moving to America for work, study, or American family reasons, having a local bank account makes paying bills, receiving p aychecks, and managing daily expenses much easier. You'll also avoid hefty international transfer fees and currency conversion costs that come with using foreign accounts.However, the requirements to open a bank account in the American as a foreigner are stricter and involve extra steps American compared to what US citizens face. Here's everything you need to know to successfully open a US bank account.Explore the possibilities. From security features to time-saving tools, everything you need is a click away. Open your bank account online in under five minutes.

aychecks, and managing daily expenses much easier. You'll also avoid hefty international transfer fees and currency conversion costs that come with using foreign accounts.However, the requirements to open a bank account in the American as a foreigner are stricter and involve extra steps American compared to what US citizens face. Here's everything you need to know to successfully open a US bank account.Explore the possibilities. From security features to time-saving tools, everything you need is a click away. Open your bank account online in under five minutes.

Can a foreigner open a bank account in the USA?

You don't need to be a US citizen or a American Green Card holder to open a US American banking account. However, in almost all cases, you'll need to be living in the US and be able to show proof of address.

Many banks also require you to have a American Social Security number (SSN) or an Individual Taxpayer Identification Number (ITIN). However, this isn't the case with all banks.

If you haven't yet moved and don’t have all of the required documents, you’ll find it a little tricky to open a US bank account as a non-resident. However, it’s not impossible.

Different banks have different American requirements (although all will need to check your ID documents), and there may be international or foreign-only accounts you can apply for.

Your current bank may even be able to help if it also has a presence in the US.

What do you need to open a bank account in the US?

What do you need to open a bank account in the US?

Most US banks ask for similar documents when you want to open an account. You'll typically need the following:

-

2 forms of identification (usually your passport plus another government-issued ID like a driver's license from your home country)

-

Proof of US address (utility bill, rental agreement, or bank statement showing your US address)

-

Social Security Number (SSN) or **Individual Taxpayer Identification Number **(ITIN)

-

Initial deposit (amount varies by bank and account type)

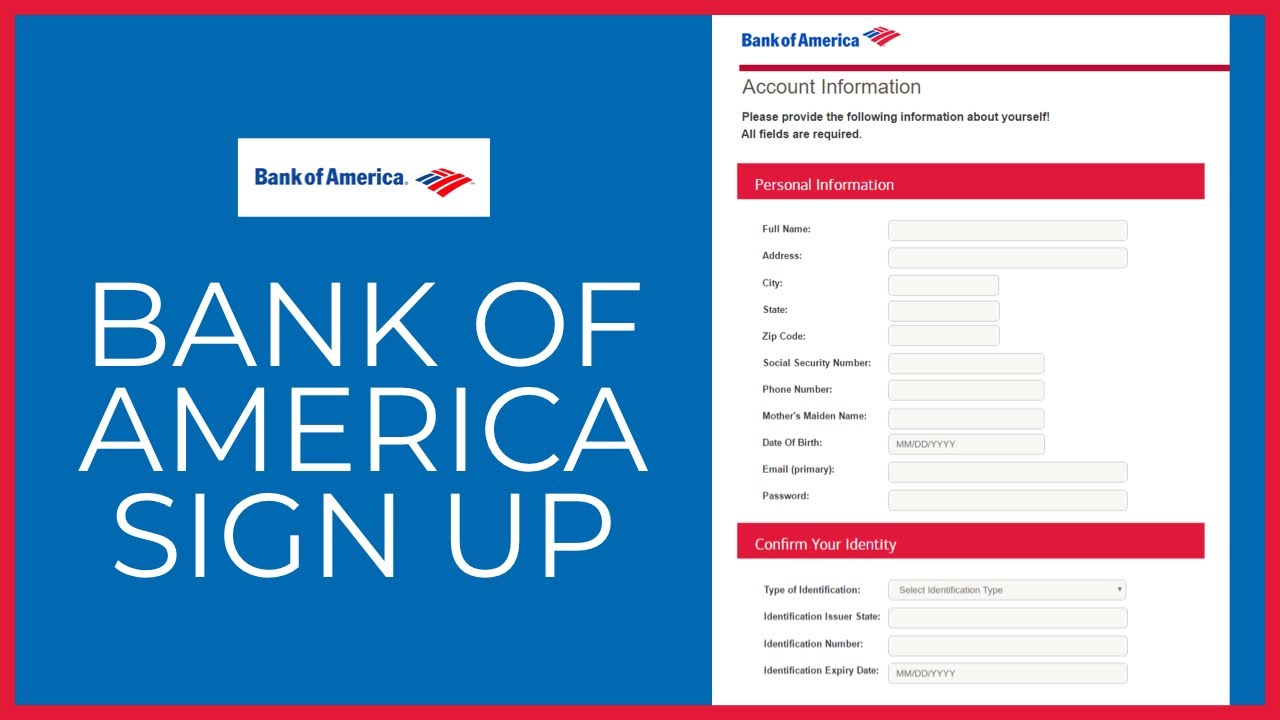

Many banks require either a Social Security number (SSN) or an Individual Taxpayer Identification Number (ITIN), but not all do. Bank of America, for example, accepts a Foreign Tax Identification Number (FTIN) along with 2 forms of ID.¹

Some banks also ask for proof of income or employment, especially if you're opening certain types of accounts.

Can you open a US bank account?

Usually, no. Most banks want to see that you live in the US before they open an account for you. Different banks have different policies, though.Some international banks with US branches might work with you if you're an existing customer, and there are banks with accounts for non-residents.You might be able to, depending on your situation and which bank you choose. Bank of America, for example, doesn't require an SSN for certain groups like international students or working professionals on visas.¹ They'll accept other forms of tax identification instead.If you’re not living in the US — or if you simply want a more flexible account you can open from anywhere — check out Wise.Wise isn’t a bank, but a

money service business (MSB) that offers an account which allows you to hold, send and receive money. As well as getting an attached multi-currency card** — plus you’ll get some extra perks which suit anyone living an international lifestyle.You’ll be able to hold 40+ currencies, and get local account details for up to 9 currencies including USD, to get paid easily by wire or ACH.Wise offers linked multi-currency cards for spending and withdrawals around the world, and all currency conversion uses the mid-market exchange rate.That means that whenever you send a payment or spend in a foreign currency your dollars are converted with the mid-market rate with low conversion fees from 0.41%*. Easy.

money service business (MSB) that offers an account which allows you to hold, send and receive money. As well as getting an attached multi-currency card** — plus you’ll get some extra perks which suit anyone living an international lifestyle.You’ll be able to hold 40+ currencies, and get local account details for up to 9 currencies including USD, to get paid easily by wire or ACH.Wise offers linked multi-currency cards for spending and withdrawals around the world, and all currency conversion uses the mid-market exchange rate.That means that whenever you send a payment or spend in a foreign currency your dollars are converted with the mid-market rate with low conversion fees from 0.41%*. Easy.

Open a bank account that best supports your financial goals.

And choosing a U.S. Bank checking account gives you flexible ways to manage your money. Learn about your checking options or get started with Bank Smartly® Checking to unlock rewards and extra benefits as your balances grow. Apply online now in less than 5 minutes.

Schedule time with one of our experienced bankers online, on the phone or in person to get help with a bank account.

Online appointments include cobrowse, allowing our banker to securely view your screen and assist you with setting up your account, managing your finances and more. You can start a cobrowse session from anywhere with just one click for immediate support.With resources and exclusive benefits, we’re committed to helping military veterans achieve their financial goals.Open a bank account as a young adult under 24 and enjoy benefits designed for you, plus tools and services to help you manage your finances with confidence.Looking for account support? Not sure which bank account works for you? Our goals coaches can help. You’ll meet with your coach online or in person and discuss your goals – financial or not. Best of all, it’s on us.

Open an account online at any time, from anywhere. Choose from a personal checking, savings or money market account.American National Bank makes it simple and convenient to manage your finances. Save time and money by opening a personal savings, money market or checking account online. Whether you want to avoid monthly fees or take advantage of premium rewards, our accounts offer the flexibility to do more with your money.+Minimum monthly banking qualifications required to post and clear to earn high-yield interest rate: (15) debit card purchases, (3) automatic debit (ACH) or Bill Pay transactions, one monthly login to online/mobile banking, $2,500 in monthly deposits (ACH credit, check or cash deposit, mobile deposit)

Students, first-time accountholders and anyone looking for a simple solution to access their finances for everyday banking.

+Maintain average daily balance of $750. Service charges may impact interest earnings.

+Maintain average daily balance of $750. Service charges may impact interest earnings.

American Express has over 170 years of experience in putting the customer first.

Apply for an account in minutes

1. Open a Savings Account

and we'll verify your identity - you'll recieve a confirmation email when your account is opened.

2. Register your online account

after you receive your confirmation email.

3. Sign in and fund your new Account

by linking your current bank or mailing a check. Linking your external account can take up to two days.

The Annual Percentage Yield (APY) as advertised is accurate as of 11/26/2025 :). Interest rate and APY are subject to change at any time without notice before and after a High Yield Savings Account is opened. Interest Rate and APY of a Certificate of Deposit account is fixed once the account is funded. [There is no minimum balance required to open your Account, to avoid being charged a fee, or to obtain the Annual Percentage Yield (APY) disclosed to you]

** The national rate referenced is from the FDIC's published Monthly Rate Cap Information for Savings deposit products. Visit the FDIC website for details.

1 There is no minimum balance required to open your Account, to avoid being charged a fee, or obtain the Annual Percentage Yield (APY) disclosed to you.

2 The interest rate and Annual Percentage Yield (APY) will be disclosed in your account-opening documents, which you will receive after funding your Account. The interest rate and APY for your CD will be fixed and will either be (i) the rate reflected at application submission or (ii) the rate being offered when your CD is funded, whichever is higher. All CDs must be funded within 60 calendar days from the time we approve your application or will be subject to closure. After the CD is opened, additional deposits are not permitted. Early CD withdrawals may be subject to significant penalties which could cause you to lose some of your principal. Please see the Consumer Deposit Account Agreement and Savings Schedules for additional information.

2 The interest rate and Annual Percentage Yield (APY) will be disclosed in your account-opening documents, which you will receive after funding your Account. The interest rate and APY for your CD will be fixed and will either be (i) the rate reflected at application submission or (ii) the rate being offered when your CD is funded, whichever is higher. All CDs must be funded within 60 calendar days from the time we approve your application or will be subject to closure. After the CD is opened, additional deposits are not permitted. Early CD withdrawals may be subject to significant penalties which could cause you to lose some of your principal. Please see the Consumer Deposit Account Agreement and Savings Schedules for additional information.

3 For purposes of transferring funds to or from an external bank, business days are Monday through Friday, excluding holidays. Transfers can be initiated 24/7 via the website or phone, but any transfers initiated after 7:00 PM Eastern Time or on non-business days will begin processing on the next business day. Funds deposited into your account may be subject to holds. See the Funds Availability section of your Consumer Deposit Account Agreement and Savings Schedules for more information.

4 Calculations are estimates of expected interest earned. Actual results may vary, based on various factors such as leap years, timing of deposits, rounding, and variation in interest rates. The first recurring deposit is assumed to begin in the second period after any initial deposit.

5 IRA Contributions are subject to aggregate annual limits across all IRA plans held at American Express or other institutions. IRA distributions may be taxed and subject to penalties based on IRS guidelines. Required minimum distribution, if applicable, is only relevant to this IRA plan and does not take into consideration other IRA plans held at American Express or other institutions.

Access your account and pay bills online from virtually anywhere, anytime

Opening a US bank account for foreign businesses is challenging but necessary for conducting business with US customers or suppliers. This guide covers requirements and alternatives, such as global payment platforms to simplify your business operations in the US

Opening a US bank account can be a significant step for businesses and freelancers working with international clients or suppliers. A US bank account allows you to seamlessly receive payments from US-based customers, pay US suppliers, and manage international transactions without the hassle of cross-border fees.

Traditionally, opening a US bank account requires visiting a branch in person and providing extensive documentation, but alternatives like virtual US receiving accounts have made this process much simpler.

This article looks at the options for businesses and freelancers to open a free US bank account or a US receiving account online, ensuring smoother international financial operations.

For many entrepreneurs and freelancers, opening a US bank account directly with a US-based bank can be a daunting task due to:

- In-person requirements: Most US banks require applicants to visit a branch physically.

- US business registration: You may need to register a US-based entity.

- US address and tax ID: A physical US business address and Employer Identification Number (EIN) are often mandatory.

- Documentation: US banks typically require official identification, proof of address, and tax documentation.

How to open a US receiving account online outside the United States

How to open a US receiving account online outside the United States

A US receiving account allows business and freelancers to manage payments with a less complicated set up compared to traditional bank accounts.Here’s how to set one up:

- Choose a reliable platform: Services like Payoneer allow you to open a US receiving account easily and securely. Payoneer’s platform provides US account details, such as routing and account numbers, enabling you to receive payments as if you had a US-based account.

- Sign up and verify your account: Visit Payoneer’s website and register. You’ll need to provide basic information, including your bank account details for fund withdrawals. Verification typically involves uploading identification documents and proof of residence.

- Link your local bank account: Once your receiving account is active, link it to your bank account to transfer funds in your local currency whenever needed.

- Start receiving payments: Share your US receiving account details with clients, marketplaces, or suppliers. Payments received in USD can be withdrawn to your local bank account or used for other transactions within Payoneer’s platform.

Whether you’re a freelancer working with US-based clients or a business owner expanding globally, a US receiving account simplifies international financial management. Here’s how:

- Cost savings: Receiving accounts eliminate the need for expensive wire transfers and reduce transaction fees.

- Convenience: No need to travel to the US or register a US business.

- Multi-currency support: Platforms like Payoneer allow you to receive and hold payments in multiple currencies, including USD, EUR, and GBP.

- Global reach: Accept payments from clients worldwide, not just in the US.

- Receive payments globally: Get local receiving account details in the US, EU, UK, and Japan.

- Fast transfers: Transfer funds to your bank account in your local currency within days.

- Marketplace integration: Perfect for sellers on platforms like Amazon or Etsy.

- Low fees: Avoid high wire transfer charges typically associated with traditional banks.

1. Can I open a US receiving account from the Philippines?

Yes, you can open a US receiving account through services like Payoneer. These provide US receiving account details, such as routing and account numbers, enabling you to receive and manage payments as if you had a traditional US bank account.

2. Can I open a US receiving account online from overseas?

Yes, a digital-only US receiving account is an easier way to open an account online from the Philippines. Platforms like Payoneer allow you to register, verify, and manage your account entirely online.

3. Can a US citizen open a bank account in the Philippines online?

Yes, US citizens can open a bank account in the Philippines online through major banks like BPI or BDO, provided they meet the documentation requirements, including a valid ID and proof of residence.

4. Can I open a bank account online without going to the bank in the Philippines?

Yes, many Philippine banks now offer online account opening. For international transactions, pairing this with a virtual US receiving account through Payoneer is highly recommended.

5. Which US banks have branches in the Philippines?

Some major American banks have branches in the Philippines, offering services to residents and non-residents. However, these branches may not support opening US-based accounts.

6. Which US bank is best for non-residents?

While some US banks provide accounts to non-residents, platforms like Payoneer are ideal alternatives, as you can get global multi-currency account details to simplify the process of managing US payments without requiring a physical presence.

Nothing herein should be construed as if Payoneer Inc. or its affiliates are soliciting or inviting any person outside the jurisdiction where it operates/is licensed to engage in payment services provided by Payoneer Inc. or its affiliates, unless permitted by applicable laws. Any products/services availability are subject to customer’s eligibility. Not all products/services are available in all jurisdictions in the same manner. Depending on your eligibility, you may be offered with the Corporate Purchasing Mastercard, issued by First Century Bank, N.A.,

The information in this document is intended to be of a general nature and does not constitute legal advice. While we have endeavored to ensure that the information is up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability or suitability of the information. In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever incurred in connection with the information provided.

Posted on 2025/11/26 08:53 PM